Room Growth (UK focused)

Again this is an aside to purely creating your own Escape Game but I’ve left it in as some many find this interesting.

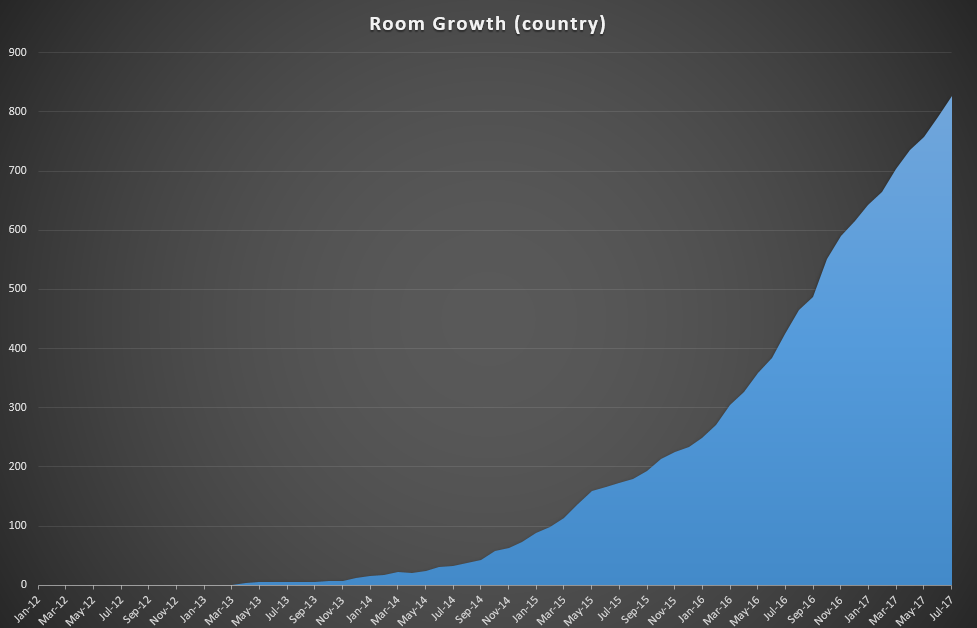

The growth of Live Escape games across Europe has been somewhat unbelievable. There was an initial boom in Europe during 2014 – when very quickly spread out of Hungary into every big city across Europe. Following that there has been a second wave as it spreads within each country. So within the UK pretty much every reasonably sized town has their own Escape Room. Larger towns and cities will generally have 2-4 competing companies. The last figures produced by the excellent Ken Ferguson of exitgames.co.uk shows across the UK there were over 800 rooms. These figures are from almost a year ago so my guess at the time of writing is that there currently around 1100.

UK & Irish Room Growth courtesy of exitgames.co.uk (July 2017)

The US shows similar expansion figures – with just 44 rooms in 2014 and the number of rooms now stands at over 1,800.

So there’s two questions to look at in terms of the growth. Where is the demand from and how are there so many business.

Why do people want to play Escape Rooms now (the philosophical bit)

(I will go back and add references and correct this accordingly later – I promise!)

Why is there a big demand for these types of experiences now. After all we’ve already mentioned that Live Crystal Maze experiences operated for around a decade before eventually closing unsuccessfully yet the new version exists in two locations, has a high entrance fee and its booked out for months.

We’ve seen a general move from people spending their money on experiences rather than things. I think because we’ve realised that we as people derive more happiness from experiences than we do things (although some things are experience enablers). Social media has a big part to play in that we’re also deriving more status from experiences than ‘things’. It’s difficult to turn on Facebook or twitter without seeing photos of your friends, family and colleagues gallivanting about having an amazing time somewhere that you’re not. There could be a connection between things generally being much cheaper (globalisation has forced down the prices of just about everything) e.g. in my parents generation TVs were so expensive that most people rented them – nowadays you can pop down to Tesco a pick up a giant 4K LCD panel for just a few hundred pounds. Although at the same time housing has increased rapidly. Your house feels like the only big purchase worth shouting about to your friends (assuming you’re fortunate to be in the position to buy one).

People are also complaining that they are time poor. So the little amount of free time that people has should be spent optimising the amount of happiness available. I find it interesting that even those on lower incomes are more likely to save to go on their one big paid experience than to go on numerous cheaper / free activities.

People have access virtually to all the content they could possibly wish for. Within seconds at your finger tips you have access to world knowledge, pretty much any film, book or TV program all music from artists living or dead and sports events in 4K beamed all over the world. You can immediately talk to / see relatives and friends the other side of the planet for free and engage in virtual experiences with them. When the virtual / digital world is so rich we crave real, physical, tangible things.

Ultimately, people are looking for very unique experiences that maximise their happiness in a short amount of time in the real world with real people and they are willing to pay a premium for it. We’ve seen this is the rise of all things independent, craft-y and along with the rise of experiences / festivals and events.

The Business Side

The reason for this success has partly been down to its low-risk start-up cost and relatively cheap costs of city centre retail property (particularly if you’re able to work from non-prime locations). The movement to online shopping and the general death of the high street means that the composition of city centre locations. There are many grounds on which physical retail can’t complete with online so those businesses that are succeeding are those that offer services that can’t be easily sold online.

For many owners it became a business that could be created on-the-side and then expanded as player demand increased. The most popular time-slots are evenings and weekends so it has been possible to initially run a successful business around a full / part-time job. If the demand is there then the business can open more rooms, extend their opening hours and employ more staff.

Interestingly we’re only seeing a handful of franchises (those that open in multiple cities) at the moment. The largest in the UK are: Escape, Clue HQ, Breakout and Escape Reality. I think it’s only a matter of time before a large company is able to produce a much cheaper / more resilient / commodity experience by employing economies of scale. While these experiences may not be as individual and high quality as the existing offerings it may significantly lower the cost and open it up to a wider audience. I think you could liken this to a giant arcade game where the players are inside.

While there are some hard-core players who will visit every room in the country – the majority of players will visit those rooms local to themselves so there is little penalty to a company owning similar or identical rooms spread across the country.

In addition we are yet to see a hugely popular branded Escape Room gain traction – so Disney or Harry Potter franchised experience could blow everything out of the water.

In the past few years we’ve seen more interest from Family Entertainment Centres and theme-parks looking into this model. The main barrier is the throughput of players. If this is to be financially viable it needs to be scaled significantly. Typically a room lasts for an hour with set-up and reset time required. This is nowhere near the numbers required for a large scale theme park (minimum of 500+ per hour). There are a number of ways to improve on this.

- Shorter games

- Multiple concurrent copies of a room

- Pipelining – rooms broken into sub rooms (e.g. 1 game is made up of 3 smaller rooms)

- Increasing the numbers in a room

- Alternative configurations (e.g. seated players, or observing players)

Revenue

Typically players are paying around £20 per room per player (more in London). Rooms are generally designed for 4-6 players. So a room is typically generating £60+ (+VAT) per 90 minute slot. There’s the potential to have around 8 slots per day. Selling 9am / 10.30am slots on weekdays probably requires some work / discounting. Therefore, with an 80% occupancy rate a single room is generating £3,000 (+VAT) per week.

It is estimated that some of the very popular London based centres (with multiple rooms) are probably turning over in excess of £1MM per year.